Key highlights include:

Over 90 businesses fed into this first review.Employer insight underpins 9 new principles and characteristics. These apply to the following in the legal, finance and accounting (LFA) route:- occupational standards

- apprenticeships end-point assessmentsHigh satisfaction among legal apprentices. They tell us we need to do more to educate young people and schools on the value of apprenticeships. But the dial is moving.The following skills are essential for future LFA professionals:- digital literacy

- data analysis

- sustainability

- “soft” skillsApprenticeships and technical education will embed the digital skills LFA professionals need.Employers are embracing apprenticeships. Evidence shows they improve equity, diversity, and inclusion in LFA sectors.Apprenticeships of the future will embed regulatory and professional body qualifications. This helps to reduce burden on apprentices. It highlights IfATE commitment to ensure apprenticeships are fit for purpose.IfATE to launch regular legal, finance and accounting stakeholder forums.

I am delighted to see the publication of the legal, finance and accounting route review. This is the eighth route review undertaken by IfATE. It is a sign that we are delivering on our commitments to put the employer voice at the heart of all that we do.

This route review will enable us to plan and deliver improvements to the route and its products in the coming years. This includes testing how occupations fit together, progression pathways and any potential gaps. Your insight helps us to ensure that our plans for apprenticeships and technical education align with the sectors’ immediate and future needs.

I would like to thank all the employers, member and professional bodies, regulators, training providers, end-point assessment organisations and apprentices for taking the time to contribute. I would especially like to thank our legal, finance and accounting route panel members and trailblazer groups. Their sector insights, advocacy and passion for vocational training helped to shape this route review and outcomes.

Your feedback is, and always will be, incredibly important to us as we work toward a world-class skills system.

Training in these long-established occupations tends to follow quite traditional routes. The expansion of the apprenticeship programme to include up to level 7 programmes opens up opportunities for a greater breadth of aspiring professionals, expanding the talent pool for employers.

The findings in this report will provide a foundation for how we will enhance how we work with employers, building on current relationships, and forging new ones to embed quality in apprenticeships and technical education.

I look forward to seeing how the sector embraces and builds upon this to create the future technical education landscape in legal, finance and accounting.

Jennifer Coupland

Chief Executive

The legal, finance and accounting route is an exciting one, with a diverse range of training opportunities. From the customer advisor we speak to in retail banks, to the economists helping to make big decisions on behalf of the nation: these roles are key in all businesses, regardless of size and geography.

The legal, finance and accounting route is an exciting one, with a diverse range of training opportunities. From the customer advisor we speak to in retail banks, to the economists helping to make big decisions on behalf of the nation: these roles are key in all businesses, regardless of size and geography.

This report is the culmination of a significant amount of insight from key stakeholders and is a testament to the passion that exists for apprenticeships and technical education. Over 90 businesses engaged with the review, and we would like to thank you for taking the time to share your thoughts with us.

We recognize the challenges around skills in these professions, with increasing regulatory expectations and employer focus on equity, diversity and inclusion in their businesses. FinTech and lawtech are growing subsectors, and we increasingly see the impact of advancing technology. All this is happening within the current political context: implementing Brexit, the conflict in Ukraine, the rising cost of living.

We want to increase the impact of apprenticeships and technical education, bring new stakeholders into the conversation, and continually assure the quality of provision. From new stakeholder forums to revision of our tested apprenticeships. The route panel will continue to represent the employer voice, supporting IfATE to innovate and have an even greater impact through its provision.

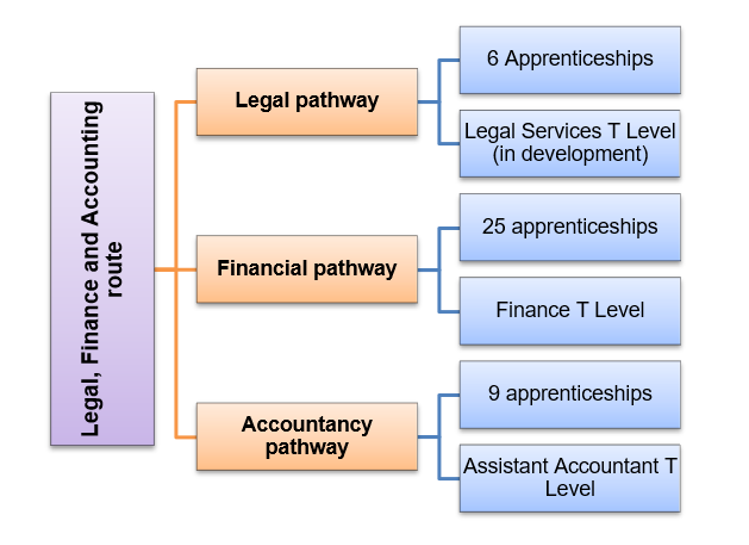

Apprenticeships aren’t new for these sectors. However, these typically existed at lower levels. Since the introduction of standards, people of any age can train up to level 7 in a range of professional occupations. The route has grown to include 40 apprenticeships and 3 T levels. So far, over 30,000 apprentices have qualified on programmes in this route. That’s impact! But we want to go even further.

As a route panel, we are very proud of the work of employers, training providers and awarding bodies to create and maintain these apprenticeships and technical qualifications, and of the successes achieved so far. We look forward to continuing to work with amazing trailblazer groups and other stakeholders as we implement the vision for the route in the coming years.

Stephen Allaker (route panel chair), Weiyen Hung (route panel vice chair).

The legal, finance and accounting route combines occupations found in all sectors. From large corporate law firms to micro-investment companies. And from charities to local and central government.

The route has three pathways (legal, financial, accountancy). Occupations include small professions, like Actuarial work. And larger ones, like Accountancy.

As of May 2023, over 30,000 learners achieved one of the 40 apprenticeships on offer in this route. These range from level 2 to level 7.

The occupational standards form the basis of all apprenticeships and the three T Levels in the route. T Levels in Finance and Accounting are available to learners now. The T Level in Legal Services will be available from September 2023.

We are working with trailblazer groups on a new apprenticeship for chartered legal executive litigator and advocate. We also expect our legal offer to expand. For example, we are exploring a Barrister apprenticeship.

Our Occupational Map includes full details of the occupational standards, apprenticeships and T Levels available. Please also see Annex A for information about technical qualifications.

IfATE uses route reviews to look across the 15 technical education routes. We consult with employers to ensure occupational standards continue to meet their needs. Reviews help us to understand future needs of employers. They also help us understand how changes in the labour market might inform apprenticeship or technical qualification needs. Route reviews look back at the performance of apprenticeships and technical qualifications. This improves our understanding of whether they are delivering for employers and learners.

Each route review has four key principles:

Strategic. The reviews focus strategically on the route and its occupational map.

Employer led. We use employer insight from consultation activities to form recommendations. These are reviewed by the route panel for that route, made up of industry experts.

Open and transparent. IfATE engages with stakeholders, including trailblazer groups, throughout the review process.

Joined up. The review’s recommendations support the wider technical education landscape. They consider the potential impact on technical qualifications within IfATE’s remit.

We want employers to see better value for their investment in skills. And help drive economic growth and productivity through ensuring training meets employers’ needs. Outcomes also aim to improve the experiences of apprentices and learners. It aims to enhance opportunities for career progression.

A route review has four main stages. The detail of how we implement each stage is specific to the legal, finance and accounting route review.

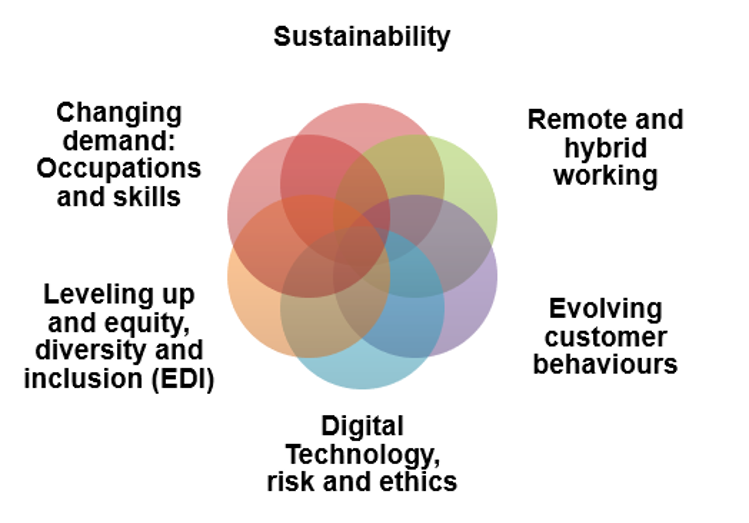

We asked stakeholders about the challenges and opportunities in their sectors. The themes reflect stakeholder engagement insight. We also reviewed current sector thinking on skills and labour market needs. Insight covers six broad, interrelated areas.

“Our profession’s ability to understand the green finance options needed for the transition to net-zero is key to equipping organisations with this expertise. Having the skills to consider non-financial as well as financial business drivers will also leave the profession well placed to lead in training staff and developing the talent needed for enabling transformation and embedding sustainability.” ACCA’s Green Finance Skills: The Guide, March 2023

Global concerns about sustainability are at an all-time high. Governments are implementing policies to achieve challenging net-zero ambitions. Regulators and professional bodies want LFA professionals to have the right skills. Nevertheless, research shows many professionals do not feel confident in their “green” skills.

Investment in skills which support a green economy is an ambition of the UK's Net Zero strategy. IfATE has a green apprenticeships and technical education advisory panel (GATE-AP). They list the apprenticeships that support the green economy. 19 of these are in the LFA route (see Annex A). IfATE’s Sustainability Framework provides a foundation for trailblazer groups to use when developing or revising apprenticeships.

Professionals at all levels are accountable for their own sustainable practice. They need to ensure that they provide sustainable products and services ethically. Their work enables organisations to meet the Competition and Markets Authority (CMA) Green Claims Code.

Stakeholders believe that professionals in LFA occupations need to understand sustainability concepts. For example, sustainable business models, green finance and investment opportunities and environmental legislation.

Sustainability impacts each pathway in complimentary and diverse ways.

Legislative and regulatory changes are not the only drivers for sustainable practice. Customers have increased social awareness. This leads to higher expectations of legal and financial service providers. For example, more customers want green, ethical, and socially responsible mortgages, and investments. More and more customers advocate for decarbonising of pensions. They also want transparency about business and investment models and their impact on climate change.

It is typical for legal professionals to specialise in one area of the law. As a result, sustainable practice will vary. This could be core requirements for sustainable practice. Or it may be understanding the environmental impact of an organisation. They may need to give legal advice when representing clients in sustainability cases.

In the future, legal professionals will need to conform with the Climate Change Act 2008. They will need to understand legal implications of planning developments. For example, a licenced conveyancer may need an understanding of environmental law. This will assist the sale or buying of property.

The Chartered Body Alliance advocates the inclusion of “green” skills in apprenticeships. They state professionals should be able to deliver banking and finance expertise with green lenses.

The sector’s Green Finance Education Charter is an outcome of the UK’s 2019 Green Finance Strategy. It is a mechanism to help build the capacity and capability of the green finance sector. The recent 2023 Green Finance Strategy continues to embed the investment in skills. It states that, "charter signatories educate, train and represent approximately 1 million finance professionals and reach many more though their public engagement and thought-leadership activities”. Most signatories are professional bodies. They deliver the regulatory training that professionals need for effective practice.

The Chartered Banker Institute recently published a report on ‘green’ in the sector. It outlines the core technical knowledge and skills that finance professionals need. The report recommends promoting the use of apprenticeships to deliver skills businesses need.

Stakeholders also believe that responsibilities for occupations that include investment analysis and advice (for example Pensions, Actuarial, Economist, Investment management occupations) should contain content on responsible investment, decarbonisation of investments and pensions, and management of the associated risk. A clear indication of the pivotal role the finance sector can play in achieving net zero.

New mandatory climate-related disclosure requirements embed non-financial reporting in an organisation’s practice. Accounting professionals will be responsible for implementation. As a result, they need to understand and be able to explain how an organisation creates, maintains or loses value over time. For example, accountants need to understand the impact of their organisation on climate change and the environment.

Hybrid working is increasingly common, with far fewer people going into physical offices. Some businesses are even downsizing workspaces since the COVID-19 pandemic. 31% of respondents in our online consultation cite “soft skills” as being increasingly important. In webinars, stakeholders felt these “soft skills” would be imperative to the success of hybrid working.

A recent ACCA report on UK Talent Trends states that two-thirds of finance professionals surveyed have hybrid working arrangements. However, the same report states that “almost half (44%) of respondents reported that they find team collaboration harder when working remotely rather than in the office. In addition, one in three employees state they are more disengaged from their manager when working remotely”. This was evident among legal apprentices that contributed to the review. While they embrace hybrid working, many felt that support from senior staff in physical offices is crucial to their development.

The ACCA report advises employers to upskill staff in remote presentation techniques, self-management, and mental health awareness when working remotely. Managers must lead remote teams, using communication applications to interact with colleagues and customers. Managers also have a greater responsibility in ensuring employees work within regulatory and legislative requirements. For example, conducting remote quality assurance of employee and customer interactions.

While each pathway has similar challenges and opportunities, recent focus in the legal sector is around maintaining client confidentiality when working remotely. Legal professionals need excellent confidentiality and risk management skills to keep client data safe.

The Financial Conduct Authority (FCA) updated its expectations for firms adopting remote and hybrid working arrangements. This includes expectations for conducting customer interactions ethically and legally. Also, financial fraud prevention protocols and others related to legislative and regulatory practice. All professionals play a role in ensuring that businesses can meet these through how they conduct their roles. We believe that embedding an understanding of these requirements across occupational standards are a key step in ensuring professionals of the future can meet these expectations.

Customers interact with legal and financial services in more diverse ways. They are increasingly savvy about how they acquire and use these services. There is a greater need for legal, finance and accounting professionals to consider the impact of their decisions on the consumer.

Ernst and Young (EY) started tracking changing consumer attitudes in 2020 using its Future Consumers Index. As of October 2022, the prevailing issues driving consumer behaviours globally are affordability and the planet. In the UK, affordability was most important. EY makes several recommendations for firms, such as simplifying choice for consumers, innovation, and education on sustainable products.

According to Reshaping Legal Services, 31% of consumers have an unmet legal need. One of the reasons for this is the result of poor legal services. The Solicitors Regulation Authority is currently consulting on their strategy to 2026. With an overarching mission statement “to enhance confidence in legal services”, objectives include “Being an authoritative and inclusive organisation meeting the needs of the public, consumers, those we regulate and its staff – This means placing our customers at the heart of all we do, working as an authoritative, inclusive and responsive organisation”.

IfATE expects that occupational standards will support the sectors to meet strategic objectives. This includes ensuring that trained legal professionals fully understand the legal needs of their customer. And that they provide services which meet ethical and regulatory standards.

In financial services, the UK government and regulators are introducing requirements around “greenwashing”. This ensures that customers receive accurate information where they prioritise sustainability in their decision to purchase a product or service. See reference to CMA Green Claims Code above. The FCA confirms that it has not had need to conduct regulatory action yet. As the journey to net zero continues IfATE is committed to ensuring that our standards include requirements for consumer protection in providing “green” products and services.

Digital transformation continues at pace with use of fintech and lawtech fuelling rapid changes in business models. This creates greater need for employees to have the right skills to interact with technology. It is increasingly interlinked with sustainable practice. It is integral in enabling businesses to meet evolving customer needs. For example, using digital tools to analyse organisation sustainability data, and to communicate with an increasingly national customer base, with higher interest in sustainable outcomes.

39% of consultation respondents cite digital skills as essential for inclusion in occupational standards. Examples include data analysis, cyber security, core skills for interacting with digital technologies, ethical and responsible data management.

Digital literacy is now a requirement for most occupations. Employers want to see this across all occupational standards. The Financial Services Skills Commission refers to digital literacy as “the ability to consume and use digitals tools and techniques to find, evaluate, create, and communicate information by everyone”. Its new skill, Digital Literacy, is embedded within the Future Skills Framework.

The Law Society’s Report on Adoption of Lawtech indicates that business-to-business legal firms are more adept at onboarding and integrating technology. However, business-to-customer firms are less mature. The same report asserts that “future proofing legal skills is going to require modifications to law school syllabuses to ensure new graduates have the right blend of legal, technology and process skills that fit with client demands and service delivery needs”. This creates a complex situation for employers developing occupational standards. They need to ensure that these are broad enough to apply to the widest range of employers. They will also need to consider the increasing range of digital skills and technological advancements impacting the workplace.

Elevated risk and ethical concerns accompany the increase in using technology. For legal professionals, the Law Society outlines its five principles on applying ethics in using lawtech. These are client care, compliance, lawfulness, capability, transparency and accountability.

FinTech usually refers to the technology that underpins financial systems and processes. With more people using online and mobile banking, the breadth of payment services and solutions, online investment platforms, fintech is materially and rapidly changing the face of financial services.

Digital innovation isn’t restricted to the private sector. HMRC’s Making Tax Digital aims to reduce the “tax gap” by requiring businesses to use digital tools to record and report transactions. As a result, accountants will need to be more digitally competent, able to use technology and to support users.

Much of the stakeholder insight suggests that accountants need skills in cloud-based accounting, programming and even machine learning. While in financial services, stakeholders mentioned skills such as working with “big data”.

Digital innovation is also key to enabling finance and accounting professionals to delivery non-financial reporting expectations, such as an organisation’s ESG practices.

As more businesses and consumers onboard and use new technologies, the risk of cybercrime increases. Added to this, methods become more sophisticated. As a result, the Financial Conduct Authority has a new Consumer Duty for firms providing regulated financial services to retail customers.

FINANCIAL CONDUCT AUTHORITY CONSUMER DUTYThe Consumer Duty sets the standard of care that firms should give to customers in retail financial markets.It sets expectations that can apply flexibly and dynamically to new products, services, and business models as they continue to emerge and develop in a changing and increasingly digital environment.It better protects consumers from current and new and or emerging drivers of harm and gives firms more certainty of our expectations to support innovation, competition and new ways of serving customers.

IfATE will work with its employers to ensure that all apprenticeships and qualifications provide the most up-to-date digital knowledge and skills. We provide a digital skills framework for trailblazers that develop and revise occupational standards.

Data for diversity in the professions represented in the route show that employers have more work to do. Stakeholder insight suggests that regulators, employers, and membership bodies believe that apprenticeships can enable a more individuals to access these professions. One respondent to our online consultation said that a major banking client uses apprenticeships to improve diversity, which resulted in a third of its intake from Black, Asian and minority ethnic backgrounds.

With increasing focus on diversity, particularly for senior roles, apprenticeships and technical qualifications can play a key role in enabling greater participation from minority groups and those from lower socio-economic backgrounds. The City of London Socio-economic Taskforce’s Breaking the Class Barrier Recommendations report cites degree apprenticeships as an effective means of growing participation in the financial services sector among those from lower socio-economic backgrounds.

As the prestige of apprenticeships grows, there is some evidence of changes in long-held feelings about apprenticeships. For example, one Solicitor apprentice commented that beliefs about apprenticeships among minority ethnic groups can be rooted in traditional views of education. DfE data shows an over 10% increase in people from minority ethnic backgrounds taking legal, finance or accounting apprenticeships between 2017 to 2018 and 2022 to 2023. Ethnic minorities (excluding white minorities) account for 25% of apprenticeship starts on the route.

Apprentices are overall content with their programmes. However, those with disabilities appear to be more likely to face hurdles. Apprentices would like providers to be more proactive and upfront about accessibility equipment and the provisions which can be made for those with learning difficulties. Overall, they believe that their workplaces enable inclusivity.

IfATE’s equity, diversity and inclusion strategy and toolkit outlines our commitment to inclusion. We believe that representation on trailblazer groups, collaboration with relevant sector bodies and ongoing review is key to ensuring that apprenticeships and technical qualifications are enabling more diverse groups to access legal, finance and accounting professions.

SOCIAL IMPACT IN LEGAL THE SECTORIn 2022, 17 legal firms signed and published the UK legal apprenticeship pledge.The pledge includes three core principles for recruitment professionals, hiring managers and promotion and development policies.The participating firms state that "by agreeing to this pledge, we make a public commitment to these recruitment and development principles, to ensure that the legal apprenticeship route is no less valuable than a traditional route to qualification.”Since its creation in October 2022 firms continue to sign up to the agreement.City of London Law Society is following this example, creating an initiative to attract more diversity to city legal firms.

Occupations in legal, finance and accounting sectors are changing rapidly in response to wider societal and political changes. We need to bring our occupational standards and apprenticeships up to date, working with the sector to prioritise and to ensure they reflect diverse employer needs. We discussed potential changes in skills and labour market demand.

“Firms are continuing their efforts to reduce costs, increase efficiency, and lean on technology more to deliver high-quality legal work. As the years go by, the makeup of law firms is gradually changing, and the rise in paralegal roles is a by-product of this.” Law Gazette.

Stakeholders in the legal sector feel that demand for senior paralegals is rising. One large employer of legal professionals uses senior paralegals to conduct much of its legal work. Solicitors provide oversight and deliver regulated aspects of the role (reserved activities). Most attendees at legal webinars felt that businesses have greater need for senior paralegals, suggesting that this is missing from the occupational map. Those closest to the occupation assert the growth of the paralegal profession as a distinct one, not simply as a stepping-stone to becoming a licenced legal practitioner, such as a Solicitor.

The UK’s audit reform and creation of Audit, Reporting and Governance Authority (ARGA), appears to be fuelling demand for more auditors and actuaries. They need skills to enable businesses to meet regulatory requirements. The recent campaign focuses on rebuilding trust in big business. ARGA could update or create new competency requirements for Audit professionals.

We also expect ARGA to have oversight for actuarial work and the Institute and Faculty of Actuaries (IFoA). This spotlights this relatively small profession. IfATE has two actuarial apprenticeships. The trailblazer group is starting work to bring these apprenticeships up to date.

We will work with other trailblazer groups to facilitate any necessary changes to our audit related apprenticeships and technical qualifications.

All legal, finance and accounting professionals work to strict anti-money laundering legislation. Responsibility for implementing this extends beyond specialists, such as those in compliance and risk roles. The UK’s Economic Crime (Transparency and Enforcement) Act 2022 strengthens earlier legislation, resulting in increased responsibilities for professionals handing any form of financial assets. According to a Law Society article, legal professionals in conveyancing practice will face criminal implications where property transactions do not meet new legislative requirements.

IfATE will support trailblazer groups to embed AML knowledge and practice across all occupational standards in the route.

“…the cost of low essential skills to the UK in 2022 was £22.2bn – comparable to the cost of low numeracy. Overlooking essential skills means overlooking a significant potential driver of UK productivity.” The Essential Skills Tracker 2023

Transversal or “soft skills” are not only essential due to changes in working practices, but stakeholders also noted their increasing need for effective transversal skills in the sectors.

In webinars, employers often noted that while apprenticeships cover technical competence in a role, they sometimes miss essential transversal skills. This was particularly the case for employers who use apprenticeships to recruit young people without prior work experience. Stakeholders mentioned creativity, flexibility, adaptability as some of the core transversal skills they would like to see in occupational standards.

Increasingly legal, financial and accountancy employers want their employees to be creative. Sector bodies are recognising this change. Financial Services Skills Commission Future Skills Frameworks now includes creative thinking as a new skill. Skills Builder Universal Framework continues to include creativity as one of the 8 essential skills.

IfATE’s new Innovation Strategy provides details on how we can anticipate and meet employers’ future skills needs. The strategy explores how we can do this efficiently, to reduce the risk of skills gaps and shortages. This strategy will underpin our work with employers to ensure that occupational standards are fit for the future.

Apprenticeship standards in legal, finance and accounting have been in use since 2015. They have over 30,000 completions to date. This review provided the opportunity to capture and theme views on apprenticeships.

T Levels in Finance and Accounting are available to learners. One provider suggested that apprenticeship lessons can be valuable for new T Levels. We encourage employers and providers to consider where apprenticeship insight can facilitate T Level delivery.

We plan to collect insight across all legal, finance and accounting apprenticeships and technical qualifications through future stakeholder engagement. Annex A provides an overview of technical qualifications.

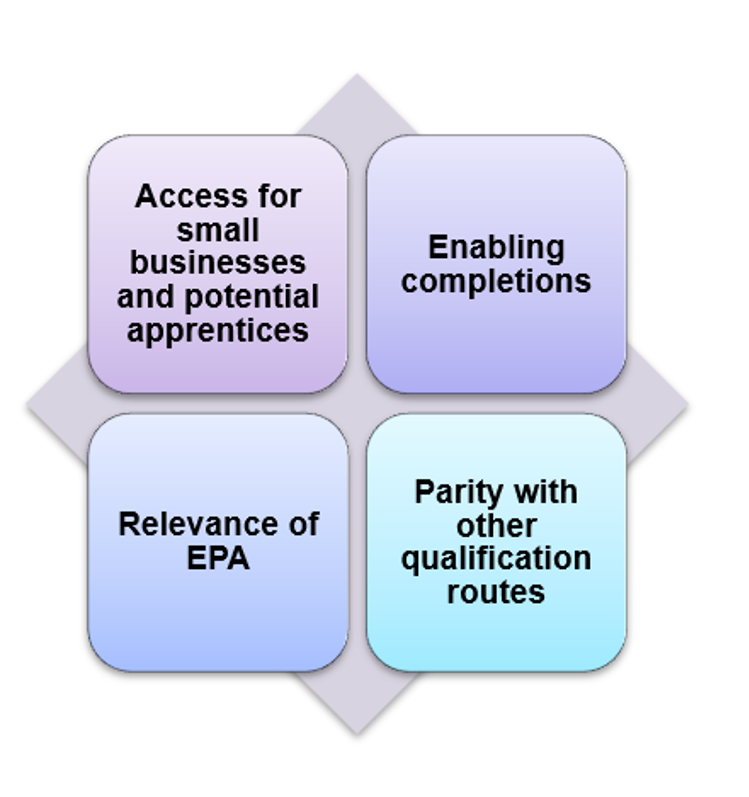

Insight covers four broad themes, shown in the image below.

Stakeholders believe that we can do more to increase the engagement of small and medium employers in the development and use of apprenticeships.

The Federation for Small Businesses (FSB) reports that small and medium sized enterprises (SME) accounts for 99.9% of UK businesses. They employ 61% of all employees. Employers of apprentices are more likely to be large businesses (250 or more employees).

57% of all starts on apprenticeship starts in the route are with large businesses (250 or more employees). This reflects that large companies are more likely to take on big cohorts.

Two-thirds of online consultation respondents were large businesses. Of respondents who employ apprentices, only 12% were small businesses. Most apprentice respondents work for a large business.

Trailblazer group members taking part in the consultation activities would like more businesses of all sizes and geographies to be involved in apprenticeships. They believe this could diversify the reach of apprenticeships and provide a greater range of stakeholders. Enabling smaller businesses to reflect on apprenticeship content will also ensure these meet their needs.

Stakeholders recommend that better partnerships and more diverse opportunities to provide feedback on programmes in development or revision can affect SME take-up.

Stakeholders, particularly those using apprenticeships in the Finance pathway, said that overall awareness of apprenticeships is low across businesses. However, even where employers are aware of apprenticeships, they need to ensure the structure and career paths are clear.

IfATE has three legal apprenticeships at level 6 and 7. These are level 6 Chartered Legal Executive, level 6 Licenced Conveyancer and level 7 Solicitor. Three legal stakeholders, one being a major provider of training for legal apprenticeships, felt that the range of legal options at level 6 and 7 should be streamlined. They recommend a maximum of two legal pathways (contentious and non-contentious) with options that align to each regulator. Though most stakeholders do not think this is necessary, they agree that more can be done to ensure that the current options are clear for potential apprentices.

Apprentices also mentioned difficulty finding information about and applying for apprenticeships. Most apprentices we spoke to had little advice from their school on apprenticeships. For example, aspiring solicitors felt they were more likely to be advised to take an academic route. Several suggested that a system like UCAS for apprenticeships would be valuable.

From 2024, young people will be able to use UCAS to search and apply for apprenticeships, alongside degrees.

Most stakeholders have concerns about the cost of delivering apprenticeships. Trailblazers are updating apprenticeships; this will include funding reviews.

A funding band is the maximum government contribution to the cost of apprentice training and assessment. It aims to support delivery of high-quality apprenticeships and represent value for money. The maximum funding band is still £27,000. IfATE will work with DfE to monitor funding bands to ensure that they meet their purpose of funding quality training and assessment.

IfATE makes evidence-based funding band recommendations to the Minister for Skills, Apprenticeships and Higher Education. The Minister (or nominee) has the ultimate decision on the funding bands for each apprenticeship.

The funding band maximum is not a funding rate. We expect that employers will negotiate a suitable price with training providers and end-point assessment organisations (EPAOs). If the costs of training and assessment go over the funding band maximum, employers are responsible for the difference.

After we approve an apprenticeship, it might be necessary to revise or amend the occupational standard, EPA plan or both. Some of these changes may require us to recommend a new funding band. New funding band recommendations can be lower, the same, or higher than the current funding band. Trailblazers give evidence to support the recommendation.

“Be clear on the purpose of the scheme. Engage with all the right stakeholders upfront. Provide wrap-around support and don’t just rely on the training provider.” Severn Trent, apprentice employer

Apprentices were overall pleased with their programmes, with 100% of those consulted agreeing that they are content with their choice of apprenticeship and employer.

Apprentice respondents also advocate for effective line manager relationships and visibility of training providers. They also advocate the importance of finding balance in a work study programme. For apprentices, these are essential aspects successful apprenticeships.

IfATE’s apprentice panel created the Raising the Standards: Apprentice Guide to Quality Apprenticeships. This outlines best practice in a range of areas affecting the apprentice experience.

Many stakeholders told us that, the maths and English qualification requirements can create barriers to entry and completion at lower levels.

The most recent changes to apprenticeship funding no longer require level 2 apprentices to achieve maths and English qualifications.

The Government’s recent Build Back Better policy paper indicates that more than a quarter of the working age population in England have low literacy or numeracy rates. It suggests that this limits employment and progression opportunities That it reduces economic growth and makes the UK a less attractive place to invest.

Department for education (DfE) data on apprenticeship achievements shows that apprentices on level 2 or 3 legal, finance or accounting programmes are more likely to complete than those on level 4 to 7 programmes.

IfATE will continue to work with employers and policymakers to refine how we can deliver literacy and numeracy skills within the course of an apprenticeship programme. We will also continually review achievement rates and engage stakeholders to understand where any apprenticeship requirements are, or can be perceived as, a barrier to entry or completion. We will share our insights with the DfE.

We asked stakeholders why they believe that apprentices withdraw. Employers gave numerous reasons including, changing jobs and promotion. They also cite achievement of mandatory qualifications and work-life balance. Their insight suggests that withdrawals from apprenticeships are not always clear. And they can be due to positive reasons, such an apprentice excelling in their work.

Some private sector employers were likely to use contractual levers to encourage completions. These include providing bonuses or promotions on completion of the apprenticeship. However, we recognise this cannot be the case for all businesses. IfATE will continue to work with the DfE and stakeholders to understand withdrawals better.

Employers and providers want up to date and relevant end-point assessments. They want assessment methods which are more in-line with occupational practice. Stakeholders also want assessment to be relevant to the level of the occupation.

Employers note the value added by an end-point assessment, with some citing the holistic and practical assessment of competence as a good model. It ensures technical competence, rather than testing knowledge exclusively.

Stakeholders also think that achievement of professional qualifications before the assessment gateway can impact completions. In essence, an apprentice may choose to leave the programme after they get their professional certification.

Professional qualifications are integral for practice in many occupations in the legal, finance and accounting route. They align to regulatory requirements for practice. The Chartered Body Alliance response to our consultation highlights the importance of professional body qualifications in finance related occupations. Other contributors who represent ACCA, ICAEW and several other professional bodies also reiterate the fundamental link between professional qualifications and ability to practice.

Stakeholders want end-point assessment and professional qualifications to work together to improve apprenticeship quality.

IfATE wants to continue to develop and build agile working relationships with professional bodies. This includes representation on trailblazer groups and regular insight and feedback. We will use this to ensure that apprenticeship completion and achievement of professional qualifications align, where possible. Our updated mandatory qualifications policy will enable better alignment.

Apprenticeships are already making a mark with the Solicitors Regulation Authority reporting that apprentice pass rates for its Solicitors Qualifying Examinations (SQE) are on average 26% higher than the overall pass rate. Legal apprentice networks are growing, with some apprentices saying that they use social media platforms like TikTok to find and share information about apprenticeships.

We expect that apprenticeships will take some time to be fully embedded in the labour market and to achieve parity with long-standing methods of qualification. We can already see this happening. Employers and apprentices increasingly see the value of apprenticeships in legal, finance and accounting occupations. They are becoming ambassadors of the programme.

Legal apprentices commented that they value being able to train while collaborating with experienced professionals, and the diverse opportunities available to them.

“I have had, Alhamdulillah, several incredible opportunities through both my employer and my own presence within the apprenticeship space. I value incredibly the voice I have been given to speak to bodies such as IfATE and the Law Society regarding topical points of discussion as a legal apprentice.” Hamza Islam, 2nd year Solicitor Apprentice at Norton Rose Fulbright

Principles and characteristics provide high-level guidance for developing and revising occupational standards, apprenticeships, and technical education products.

We develop these using the insight on the challenges and opportunities and apprenticeship themes in this report.

Employer groups should take note of the principles and characteristics. They should embed them as relevant in the duties, knowledge, skills, and behaviours in occupational standards and in apprenticeship end-point assessments.

Given the diverse practices across the sectors represented in the route, we do not expect all principles and characteristics to apply to all occupational standards. Nor to all apprenticeship end-point assessments. We want employer groups to use their discretion on how and where they apply these. And we want them to continue to prioritise describing occupational competence. Officials and the Route Panel will review how groups incorporate these.

|

Principles and characteristics |

Factors to consider |

More information to support trailblazers |

|

Core and technical digital competence |

Level, scope, and application of the occupations. For example, some may include only core digital literacy, using technology to innovate. Others may include technical data analysis and management, cloud computing. Depending on the pathway and occupation type, groups may consider how to incorporate the impact and use of lawtech and fintech to develop and deliver services. |

Financial Services Skills Commission Future Skills Framework |

|

Legal, secure and ethical use of digital technologies |

Level, scope, and application of the occupation. For example, a financial analyst may need more technical skills. Regulatory, legislative, and ethical requirements for consumer data and asset protection. Membership and professional body principles for practice that they can include. |

|

|

Sustainability practice and reporting |

Essential sustainability skills Regulatory and legislative reporting and practice requirements for certain legal, financial and accountancy professionals. Occupations likely to require more technical understanding of environmental or sustainability legislation. Occupations likely to require technical knowledge about products and services. For example, occupations in pensions, investment, accountancy may require more technical skills and in-depth knowledge of the product or service they offer, to minimise the potential for “greenwashing”. |

|

|

Transversal skills |

Core transversal skills for everyone, in particular to deliver effective hybrid working. How transversal skills may evolve from level 2 to level 7 occupations. The potential for explicit inclusion of knowledge, skills and or behaviours that cover creativity, flexibility, and adaptability. |

All occupational standards should include transversal skills such as team working, leadership and creativity, relevant to the scope and level of the occupation. Trailblazers can use: Skills Builder Universal Framework Financial Services Skills Commission Future Skills Framework |

|

Customer service and consumer protection |

Regulatory and legislative requirements for customer insight analysis and protection. For example, FCA’s Consumer Duty Ethical considerations AML knowledge and skills for all occupations |

|

|

Equity, Diversity, and Inclusion

|

Representativeness of the trailblazer. Consider businesses represented and consulted in terms of size, geography, sector. Diversity of membership and steps that can be taken to improve diverse insight. Use of language. To ensure that all potential users can interact with occupational standards, as far as possible, trailblazers should ensure language is simple. |

|

Principles and characteristics |

Factors to consider |

More information to support trailblazers |

|

Integration of professional qualifications |

Likely scale of apprentice assessment. Will it be manageable?Will assessment be, or perceived to be more onerous than other routes to qualification? If so, is it right?The point at which it will be essential for an apprentice to achieve the relevant qualification. For example, some occupations require a licence to practice before any workplace activities can take place. |

Apprenticeship end-point assessment development policy |

|

Regulatory alignment |

Is there a statutory regulator?Do they have set competency requirements?Are the competency requirements current and aligned to real labour market needs? For example, where a regulator is due to update its requirements, it may not be proper to align the end-point assessment. |

|

|

Relevance of assessment methods to the occupation |

Will the selected methods reflect current practice? Will they be accessible for the greatest range of learners? |

Stakeholders were content that the occupational map includes legal, financial and accountancy occupations. In the main, feedback was around clarity of options and visibility of progression opportunities. In discussions on progression, stakeholders identified two occupations to add to the map.

Several stakeholders highlighted that progression within pathways appears limited in some cases. They proposed:

Stakeholders also felt that we should have a distinct occupation for:

We encourage anyone interested in developing these to email us. All new occupational standards and apprenticeships will be subject to our approvals process.

In response to feedback, we considered moving the following occupations to the Business and Administration route (HR Pathway).

These occupations are typically found in HR functions within businesses. A minority of stakeholders suggested that moving these would be welcomed.

On further investigation, it was felt that the technical nature of these occupations better align with others such as Level 3 Assistant Accountant in the legal, finance and accounting route. We will ensure there are clear messages, showing their alignment to HR functions within businesses.

Stakeholders want to see clearer links to occupations in the digital route. In finance, this reflects the growth of fintech and transferability of digital occupations to financial services. For example, many financial services firms use Data Analyst and Digital Technology Services Professional apprenticeships.

Our new occupational maps show progression opportunities within and across the 15 technical education routes. We test these with employers and will update them regularly.

IfATE commits to ensuring we are supporting employers to develop quality occupational standards. We believe our commitments will enable our stakeholders to meet the challenges and secure the opportunities now and in the future.

Commitment 1: Convene quarterly legal, finance and accounting stakeholder engagement forums. These will range from route, pathway, and product specific forums.

Harnessing the significant growth in employer engagement through the route review, we envisage using these forums to discuss pressing issues, changes in the labour market, and their potential impact on IfATE work in legal, finance and accounting. We will collect and use stakeholder feedback on apprenticeships and technical qualifications to improve quality.

We have seen how employers embrace and value apprentice insight. Apprentices are enthusiastic about their programme and advocacy among peers appears important. We want to channel this passion, using apprentice insight to build in value.

We will introduce discussions about T Levels in Finance and Accounting, and the upcoming T Level in Legal services, into future forums. We also expect the same for future technical qualifications in the route.

We will share full details of planned forums with stakeholders soon. Please register for updates by emailing us.

Commitment 2: Bring all occupational standards up to date, incorporating the most up to date knowledge, skills and behaviours needed for occupational competence.

We recognise that the significant changes across the sectors represented means we need to move swiftly to bring trailblazer groups together and update occupational standards. We will work with trailblazers to include digital and green competence in occupational standards.

Commitment 3: Develop and deliver a communications strategy to boost stakeholder engagement in legal, finance and accounting trailblazer work.

We will develop a plan for increasing stakeholder engagement in the development and maintenance of apprenticeships and technical qualifications.

We recognise the commitment of trailblazer groups, delivering quality apprenticeships, often as volunteers. We also understand that some businesses or professionals may not be able to commit considerable time to developing products.

Commitment 4: Regular, systematic promotion of the value of legal, finance and accounting apprenticeships and technical education.

We recognise the key role for apprentice and employer advocates in sharing messages. We plan to conduct further activity to ensure our stakeholders are aware of and can articulate the merits of apprenticeships. And, in the future, the merits of technical qualifications in legal, finance and accounting.

Working with other government departments and sector bodies, we will spotlight the opportunities and benefits of legal, finance and accounting apprenticeships and technical education.

Commitment 5: Update our legal, finance and accounting occupational map to show:Career progression opportunities in legal, finance and accounting (LFA) occupationsCareer progression opportunities between LFA occupations and those across the other 14 technical education routesClear description of each occupation on the LFA occupational map so stakeholders can better distinguish the opportunities available

Finally, with the breadth of choice in these sectors, IfATE is committed to ensuring that that our occupational maps show the interconnectedness and progression opportunities. And, that our standards articulate occupational competence using simple accessible language.

We will ensure that the alignment with digital apprenticeships and technical education is clear.

We appreciate the efforts of employers who engage with us. Their input helps to ensure apprenticeships and technical qualifications are relevant and future facing.

We are committed to delivering our recommendations. Our product managers will work with trailblazer groups to bring occupational standards and apprenticeships up to date.

All changes will be subject to IfATE’s approvals process.

We will continue to liaise with the sector to deliver our commitments for collaboration, quality, and transparency in legal, finance and accounting apprenticeships and technical qualifications.

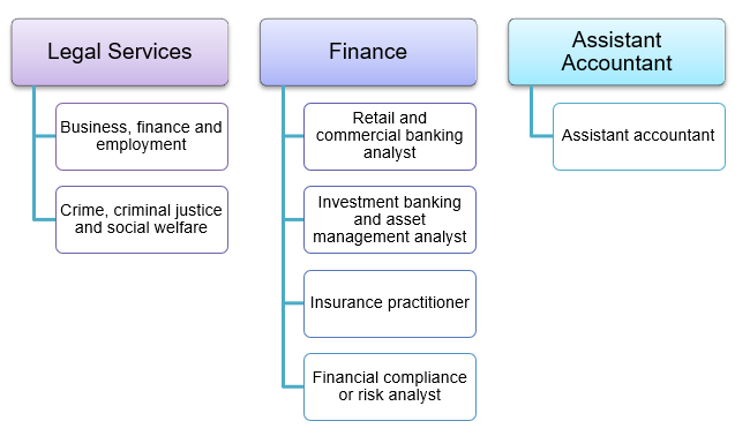

The legal finance and accounting route currently has two technical qualifications: T Level in Finance and T Level in Accounting. The T Level in Legal services will be available for learners in 2023.

We expect to see more technical qualifications in the route as we continue to approve higher technical qualifications (HTQs) and post-16 qualifications. Providing more opportunities for progression in legal, finance and accounting occupations.

Our website includes detailed information about all the qualifications that IfATE approves.

The Department for Education introduced T Levels to schools and colleges in 2020. The first cohort of learners are doing well, with an overall pass rate of 92%.

T Levels in finance and accounting are now available for learners. A new T Level in Legal Services will be available from September 2023.

Employers develop T Level content to align with occupational standards that underpin apprenticeships. Each has a mandatory “core” and several options for learners to choose from.

This list shows the T Levels in the route and the specialisms.

Each T Level has a progression profile.

These show options for progression after a T Level. It includes:

We confirm progression profiles with employers and their representative bodies. The illustrate some options for progression, but not all.

We update progression profiles regularly.

HTQs are level 4 or 5 qualifications that have been quality marked by IfATE to show their alignment to occupational standards.

Awarding bodies can submit new or existing level 4 or 5 qualifications for IfATE’s approval. They will get a quality-mark if they meet IfATE’s approvals criteria. HTQs allow learners to enter or progress in their chosen profession or onto higher education.

When we approve new HTQs in the legal, finance and accounting route, they will appear on the occupational maps, alongside their related occupational standards.

IfATE is currently working with awarding bodies to approve level 3 post-16 technical qualifications for:

This first approval cycle will include qualifications aligned to occupational standards in:

Awarding bodies can submit legal, finance and accounting qualifications for approval in a future cycle.

Skills bootcamps are free flexible courses of up to 16 weeks for people looking for a new role or job opportunity. The Department for Education develops these, with IfATE support.

Skills Bootcamps are available in many areas. This includes business and administration, digital and green roles.

Many of these can lead to progression into more technical legal, finance or accounting occupations. They also give learners skills that are essential for employers.

Employers can use skills bootcamps to onboard new employees and develop current staff. One key benefit is the access to accelerated apprenticeships.

Published 8 June 2023

Last updated 8 June 2023

(KL, NS)